24/7 Access to

Global Markets

Invest in global markets with the simplest approach

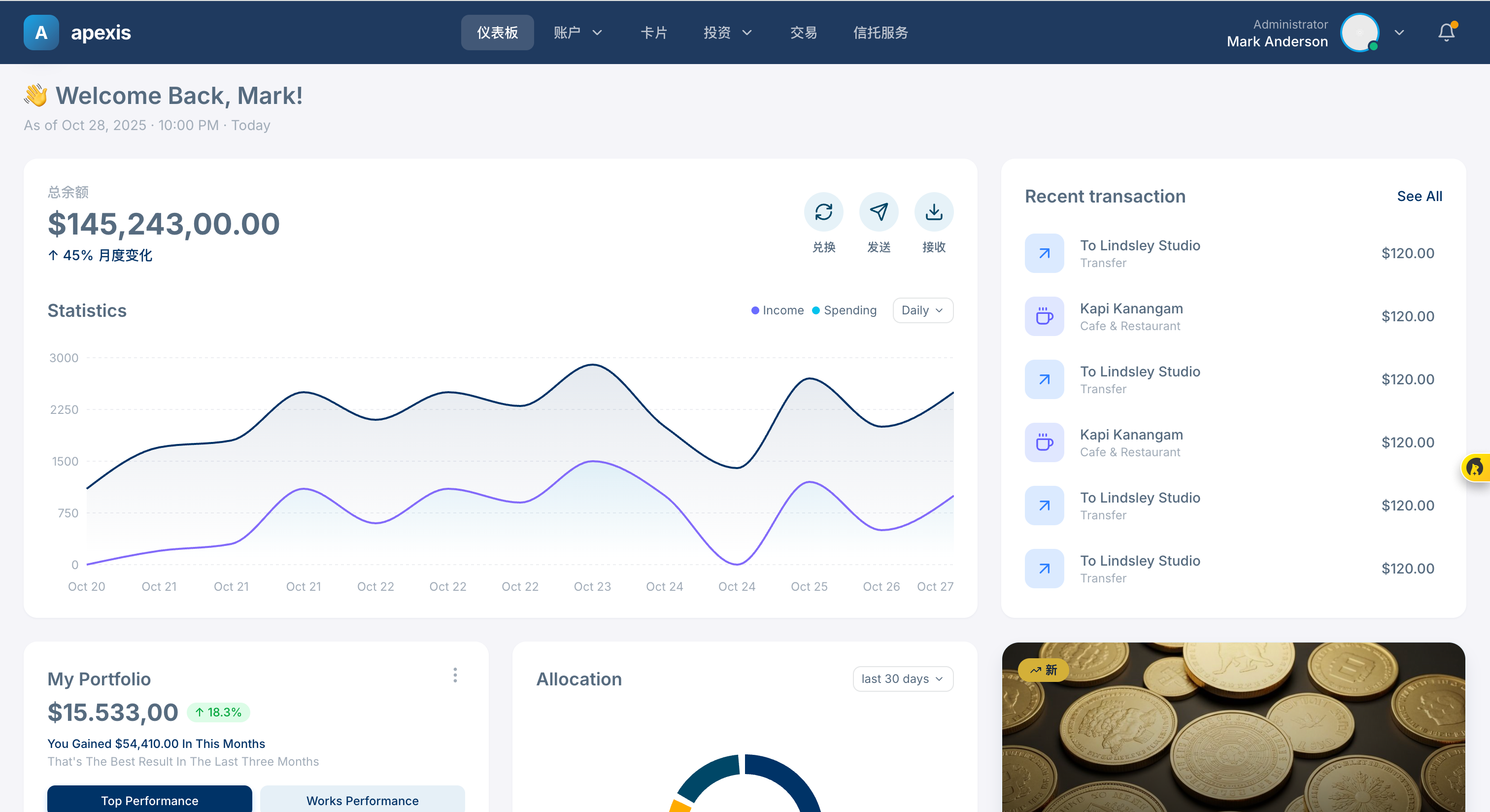

Consolidate all your investments under a single trust account, protecting your assets from regional instability and political uncertainty. Achieve global diversification through multi-currency holdings with round-the-clock forex management services.

One Account,Unlimited Possibilities

Build your diversified investment portfolio with ease through FIDERE TRUST, accessing premium global assets.

Stocks

US, HK, and Chinese stocks - premium equities worldwide

Funds

Diversified mutual funds and ETF products

IPO

Initial public offerings and international stock subscriptions

Bonds

AAA Rated

Government and corporate bonds

Options

T+0 Trading

Flexible investment strategy options

Structured Products

Customized

Customized solutions for professional investors

Fixed Deposits

4.5%+ APY

Stable and secure investment options

Staking

Flexible Redemption

Earn yields by supporting blockchain networks

Experience FIDERE TRUST Benefits

No Capital Gains Tax in HK

Maximize your investment returns in an environment with no capital gains tax, allowing profits to grow tax-free.

No Lengthy Account Opening

Start your investment journey quickly with our streamlined, hassle-free account opening process.

24/7 Global Market Access

Access global markets anytime for dynamic, round-the-clock investment opportunities.

No High Minimum Requirements

Invest without high costs or hidden fees, making participation accessible to everyone.

No In-Person Visit Required

Open your account remotely without the need to visit in person.

Trust Account Advantages: Beyond Traditional Banking

Discover why trust accounts offer superior advantages in wealth management and asset protection

Everything You Need to Know

Create a FIDERE TRUST account by submitting your ID, proof of address, and a selfie to begin your investment journey. Once approved within a few business days, you can fund your account and start trading.

No, FIDERE TRUST does not set high thresholds or minimum investment requirements, allowing all investors to participate.

Our platform provides 24/7 global market access, allowing you to manage and optimize your investment portfolio anytime, anywhere.

At FIDERE TRUST, earning your trust and ensuring the safety of your assets is our top priority. As trustees and custodians of legal ownership, all assets are held by licensed financial institutions or top-tier custodians. This structure provides strong security for your wealth.

The Trustee Ordinance (Cap. 29) Section 3A requires trustees to exercise reasonable care and skill as circumstances require. Section 97 further stipulates that employees of trust corporations are personally accountable to the court.